Tax Rate Implications

The new top tax rate

A new top tax rate of 39% will apply on personal income in excess of $180,000 for the 2021-2022 and later tax years. This takes effect on 1 April 2021 and is said to apply to the top 2% of tax payers.

To put this in perspective a 6% increase from 33% is equivalent to $3,000 in tax for every additional $50,000 of income over and above $180,000.

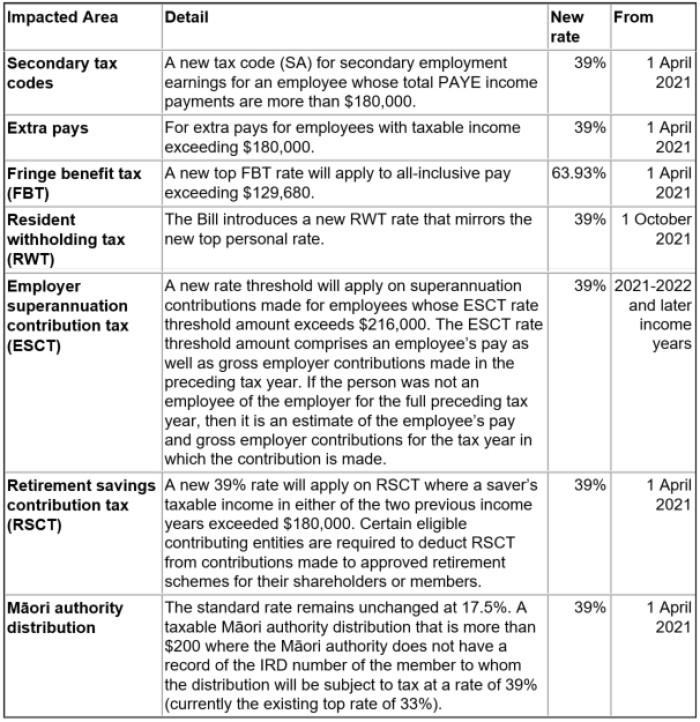

There are also some corresponding changes to other tax types including FBT to align with the 39% rate. These can be found in the table below.

There is an immediate consideration to be made around the timing of upcoming dividend payments for companies with significant retained earnings balances. We are working through making contact to clients where this applies, so you may of heard from us already but feel free to reach out to us if this applies to you and we can discuss the implications and steps we should take as soon as possible.

Changes to other tax rates to align with 39%